How To Backtest Forex For Free

Are you tired of blindly entering trades in the forex market without any idea about their potential profitability? Have you ever wished for a way to test your trading strategies before risking real money? If so, then backtesting is the solution you’ve been searching for! In this blog post, we will show you how to backtest forex for free – giving you the confidence and knowledge needed to make informed trading decisions. So sit tight and let’s dive into the world of backtesting!

What is backtesting?

Backtesting is a method of testing hypotheses about future market movements by simulating past conditions. When used in the forex market, backtesting can help traders identify opportunities and identify potential risks associated with trading forex. Backtesting is also useful for identifying profitable trading strategies.

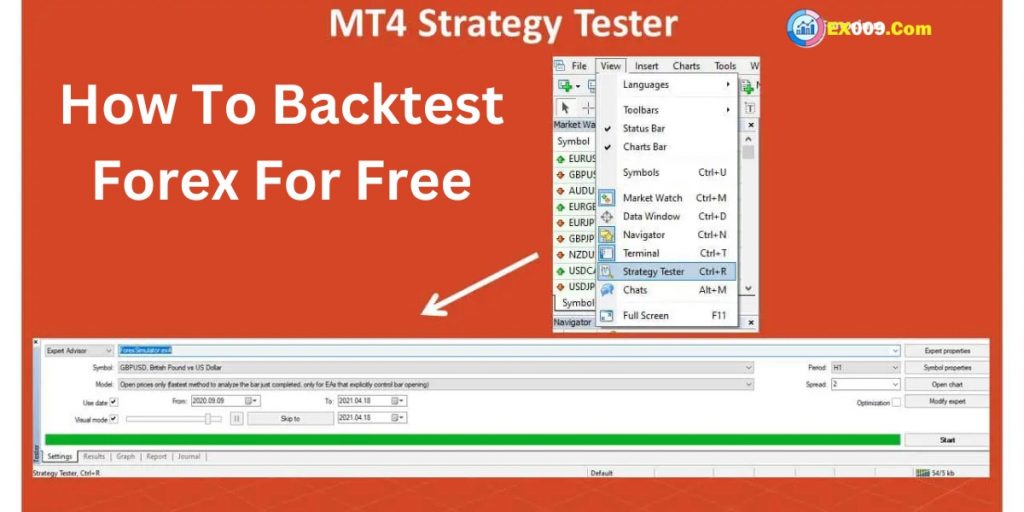

There are several free backtesting platforms available online. One popular platform is MetaTrader 4 (MT4). MT4 allows you to run multiple simulations at the same time, which makes it ideal for complex backtests. You can also use other platforms, such as Excel or Google Sheets, to run backtests. However, MT4 is generally considered the most user-friendly platform.

Before starting a backtest, it’s important to have a clear understanding of your goal. This includes defining the timeframe over which you want to test and the currencies that you will be trading. Next, you need to gather data about historical market movements for the currencies that you are interested in trading. This data can come from websites like CoinMarketCap or TradingView. Once you have this data, you can start running your simulations.

One common mistake that traders make when conducting backtests is using unrealistic simulation parameters. For example, some traders might assume that all markets move in lockstep and that there are no intra-day price differences.

In reality, markets are driven by underlying fundamentals and factors such as news events can cause large intraday price discrepancies. It’s important to test different simulation parameters to ensure that your strategies are effective in the real world.

Backtesting is a valuable tool for forex traders, but it’s important to be aware of the risks involved. Always consult with a financial advisor before starting a backtest.

Best Forex Trading Platform in the USA

Looking for the best forex brokers? Look no further than ex009! ex009 offers a wide variety of indicators, trend indicators, momentum, forecasts, volatility, volume, and more to help traders achieve profitable forex trading strategies. Whether you’re a beginner or an experienced trader, the ex009 library of tools will help you take your trading to the next level. So what are you waiting for? Sign up today and start profiting from the Forex market!

The forecasts section includes a wide range of forex prediction models, including linear regression models and neural networks. These models can help traders anticipate future events and exchanges rates movements. The volatility section provides real-time updates on currency prices throughout the day. This information can be used to make informed trading decisions.

How to do backtesting for forex?

Backtesting for forex is a great way to learn about the market and find opportunities before they become real. There are many free platforms that allow you to backtest, but some of the better ones include XTB and MetaTrader 4.

First, you will need to create an account with one of these platforms. Once your account is set up, open the platform and click on the “Accounts” tab. Under “Forex Accounts”, select the account you want to use for backtesting.

Next, click on the ” Markets ” tab and then under “Scenes”, select “Create New Sample”. This will open a new window where you can enter your parameters. The most important parameter is the currency pair (e.g., EUR/USD),

but you can also set other factors such as time frame (in hours or days) and simulator type (simple or realistic). Click on the “Start Trading” button to begin backtesting.

What are the benefits of backtesting forex?

Backtesting is a method of testing how a security or investment strategy would have performed in the past. Backtesting can be used to determine if a security or investment is undervalued or overvalued and whether it is worth investing in. There are many benefits to backtesting forex:

Forex traders can learn how their strategies will perform under various market conditions by simulating historical conditions. This allows them to identify trends and developments that might otherwise go unnoticed.

Forex traders can also refine their strategies by testing different parameters such as timeframes, assets, and trading ranges. By doing this, traders can find the best combination of strategies for their individual trading styles.

Lastly, backtesting can help traders identify any potential problems with their strategies before they actually implement them into live trading. By spotting potential issues early on, traders can avoid any detrimental consequences of trading mistakes.

Backtest Forex For Free

In this article, we have outlined the basics of backtesting forex for free. By understanding how to do this, you can develop a better understanding of how markets work and improve your trading strategies accordingly. Thanks for reading!